by Mike LaFirenza

The U.S. economy has had an uneven recovery from the COVID-19 pandemic. By some metrics, the economy has bounced back and is growing rapidly: GDP in the last quarter of 2021 grew by 7.0%, the unemployment rate dropped to around 4%, and wages are increasing sharply. But the economy is continuing to struggle in other ways: inflation is at historic highs, supply chain challenges persist, and labor force participation remains below pre-pandemic levels.

Homeownership is another example of the pandemic economy’s mixed effects. The value of homes has never been higher, with buyers in markets nationwide competing fiercely for real estate and driving prices up. But many current homeowners who aren’t looking to sell are struggling, as economic hardships during the pandemic have made it difficult to keep up with mortgage payments. And with the Omicron surge this past winter bringing even more disruption to jobs and businesses, the months ahead could continue to be challenging for many homeowners.

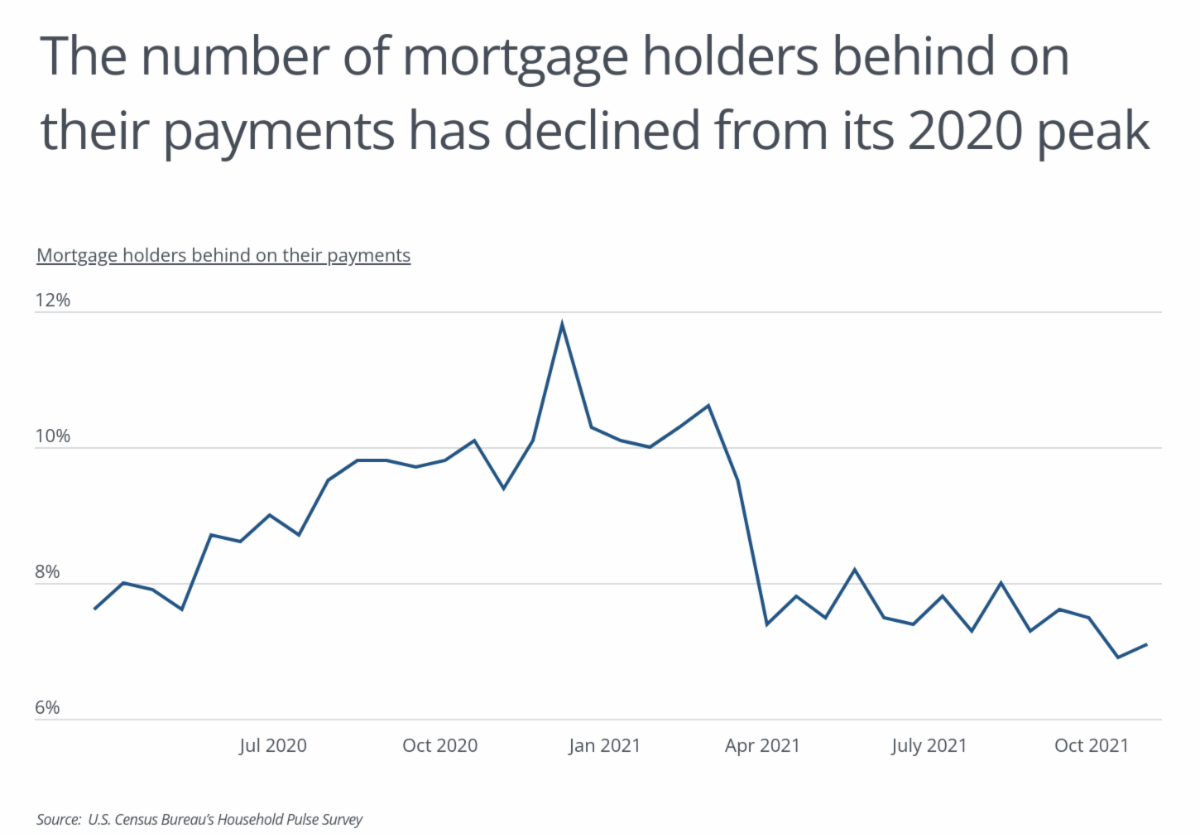

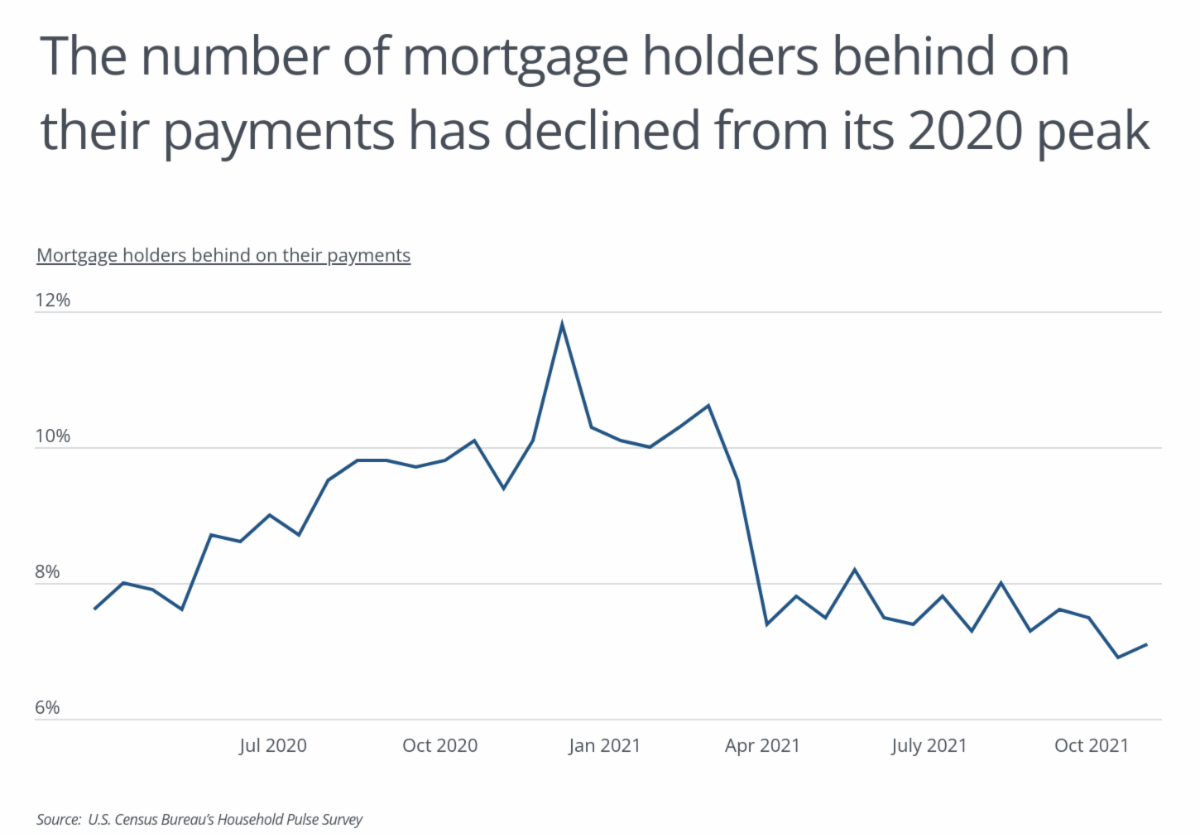

The share of U.S. mortgage holders who reported being behind on mortgage payments during the pandemic reached a peak of nearly 12% in December of 2020, according to the U.S. Census Bureau’s Household Pulse Survey. At that time, the U.S. was also enduring another wave of COVID-19 that brought economic disruption to jobs and businesses. Since then, with vaccines allowing people to work more safely and minimizing further disruption to businesses’ operations, the percentage of mortgage holders behind on payments has declined to around 7%—an improved figure, but one that still represents more than 6 million American households.

|

Further, certain segments of the population have had a harder time keeping up with payments over the last two years than others. One of the clearest differences is income level. Low income professions and workers have been more disproportionately affected by pandemic-related disruptions, and with less financial cushion, low income households struggle more with unexpected economic challenges. As a result, 16.8% of mortgage holders making less than $25,000 annually report being behind on payments, compared to just 2.2% of those making $150,000 or more.

Age is another factor where differences appear. Older mortgage holders may have built up more equity in their homes and have retirement savings and guaranteed income from Social Security to help cover expenses. Just 4.4% of mortgage holders aged 65 and over are behind on payments, a much lower figure than that of their younger and middle-aged counterparts.

|

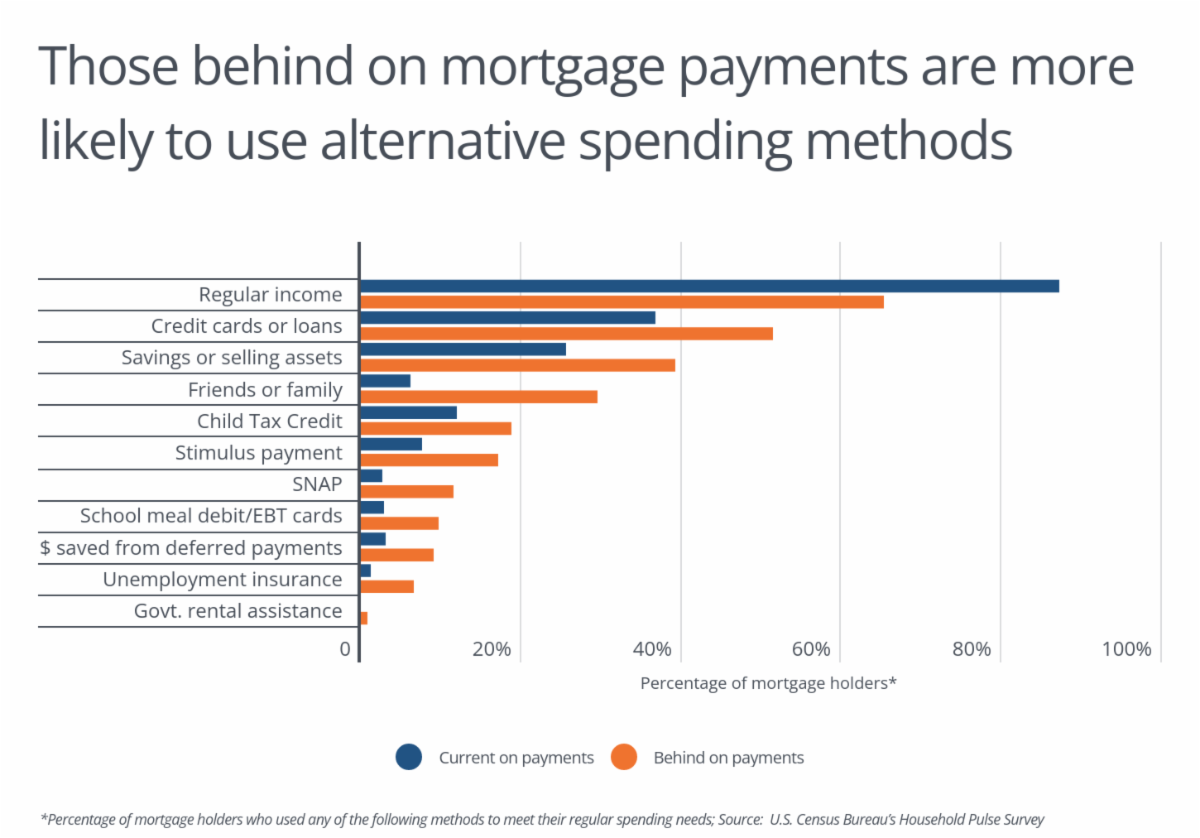

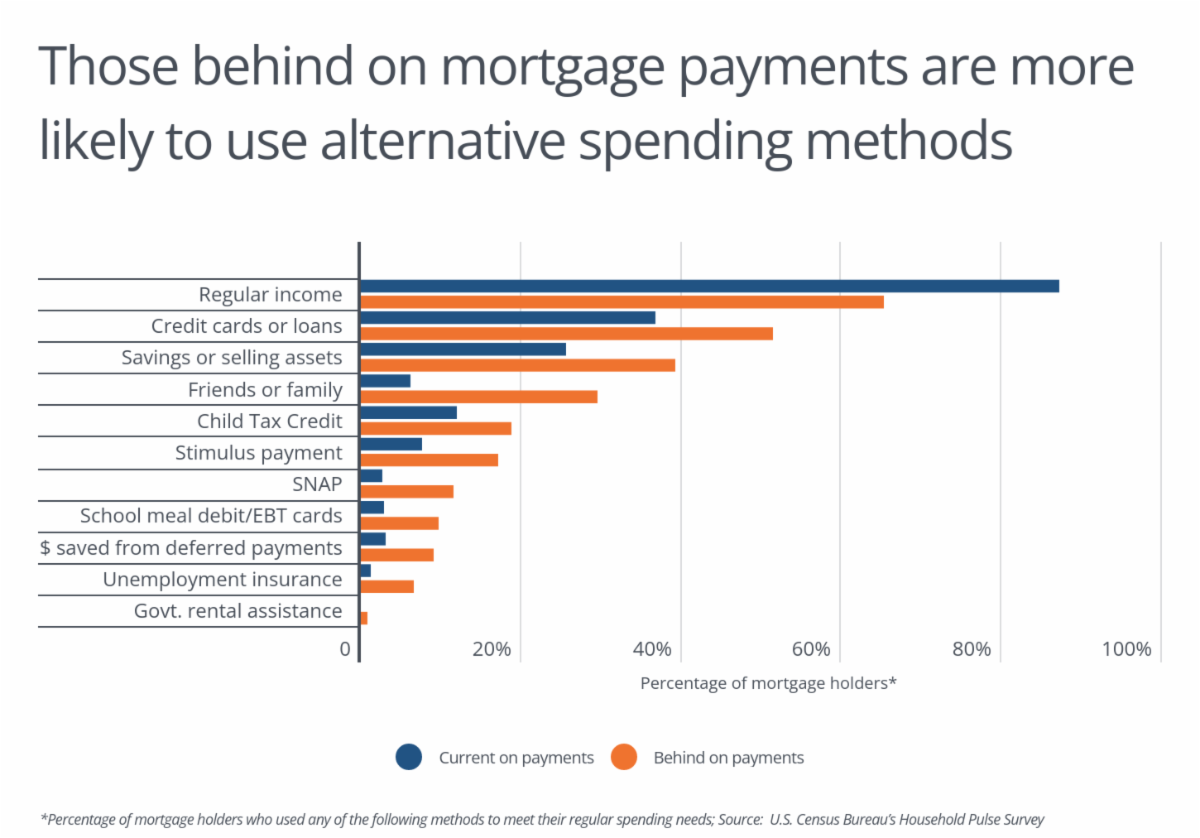

With pressure on household finances from COVID’s economic effects, struggling households must often be creative to make ends meet. While 87.1% of mortgage holders who are current on payments report using regular income to meet spending needs, only 65.3% of mortgage holders behind on payments are doing the same. Instead, people who are behind on payments are more likely to rely on credit cards, savings, friends or family, or government relief to cover their usual expenses.

|

Challenges with mortgage payments and the associated pressures on household finances look different across the country. Some of the states with the most people behind on mortgage payments are also those with lower incomes, like Mississippi, Alabama, and Louisiana. In these locations, lower-income homeowners may not have the savings or financial resources to keep up with payments. But some states with higher incomes also have high shares of people reporting that they are behind on mortgage payments. In these states, like New Jersey, Hawaii, and California, housing costs are higher, which may increase the financial difficulty for homeowners in case of lost income.

The data used in this analysis is from the U.S. Census Bureau. To determine the states with the most mortgage holders behind on their payment, researchers at Stessa calculated the percentage of mortgaged households who reported not being current on their mortgage payments. In the event of a tie, the state with the higher percentage of mortgaged households lacking confidence in their ability to pay was ranked higher.

The analysis found that in California, 9.0% of mortgage holders reported being behind on their payments heading into 2022, with 27.5% lacking confidence in their ability to pay. Out of all U.S. states, California had the 9th highest percentage of mortgage holders behind on payments. Here is a summary of the data for California:

- Mortgage holders behind on their payment: 9.0%

- Mortgage holders lacking confidence in ability to pay: 27.5%

- Total mortgage holders behind on their payments: 859,036

- Total mortgage holders lacking confidence in ability to pay: 2,620,556

- Median household income: $83,056

- Poverty rate: 11.4%

For reference, here are the statistics for the entire United States:

- Mortgage holders behind on their payment: 7.1%

- Mortgage holders lacking confidence in ability to pay: 27.4%

- Total mortgage holders behind on their payments: 6,413,232

- Total mortgage holders lacking confidence in ability to pay: 24,790,322

- Median household income: $67,340

- Poverty rate: 11.9%

For more information, a detailed methodology, and complete results, you can find the original report on Stessa’s website:https://www.stessa.com/blog/states-with-highest-percent-people-behind-on-mortgages/

TELL YOUR FRIENDS ABOUT CITIZENS JOURNAL Please keep us publishing – DONATE