Mike LaFirenza

Unusually high demand in the real estate market has been a consistent fact throughout the COVID-19 pandemic. While real estate sales—like most aspects of the economy—ground to a halt in March and April of 2020, buyers since then have been snapping homes up quickly, often offering to pay above asking prices and make other concessions to land a deal.

Part of the reason for this spike in demand has been favorable economic conditions for middle- and upper-income earners. While lower-wage workers were at much greater risk of economic instability during the pandemic, most professional class workers were able to keep their jobs by transitioning to remote work, save money from reduced spending in categories like travel, entertainment, and food, and enjoy strong returns in the stock market. Good household financial conditions and low mortgage interest rates put homeownership within reach for many buyers.

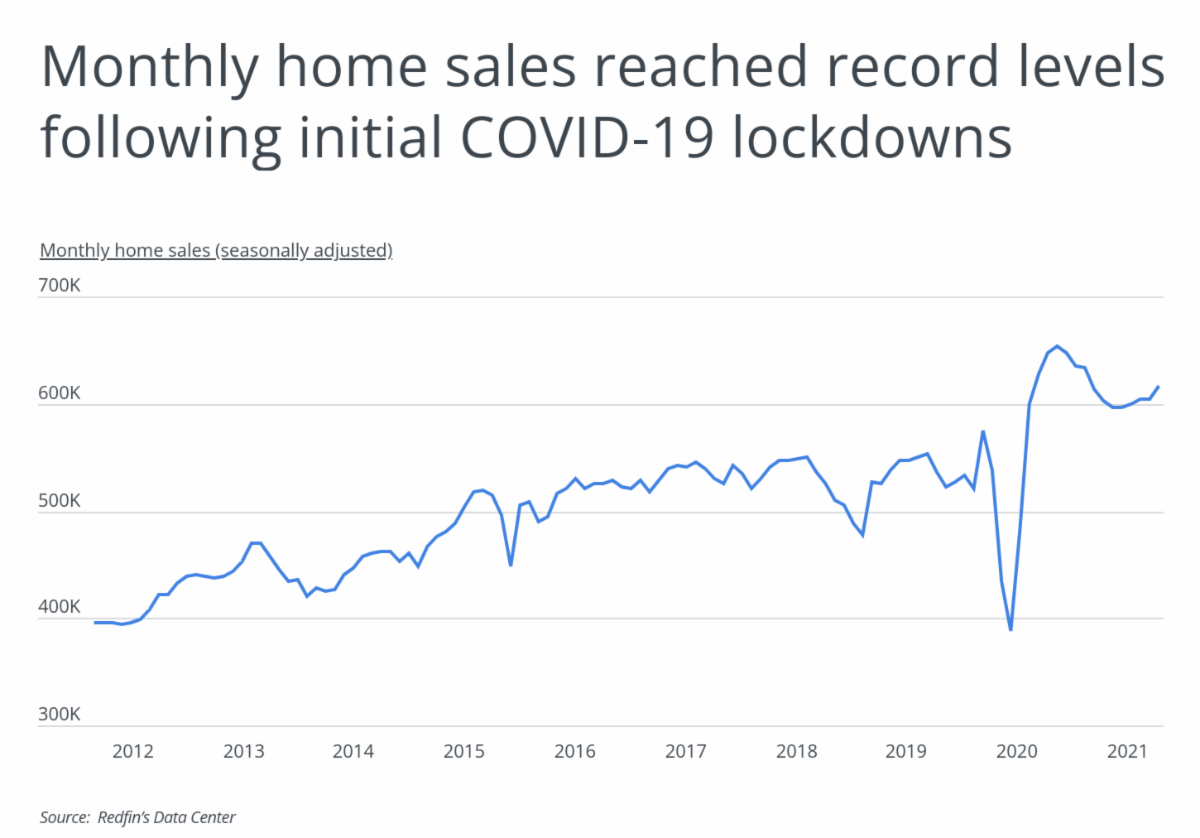

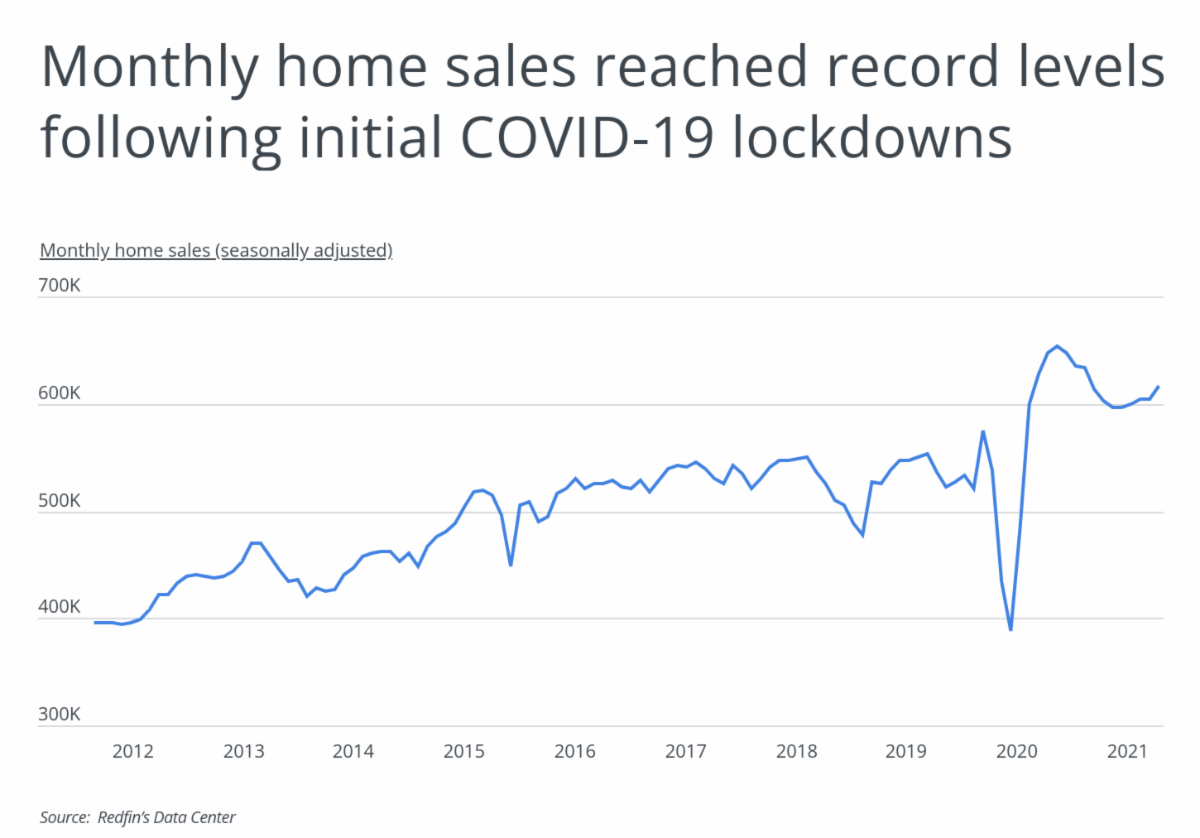

The total volume of home sales nationwide shows the extent of this demand. Seasonally-adjusted monthly home sales dropped sharply early at the start of the pandemic to less than 400,000 in May 2020 but rebounded to a peak of more than 650,000 in October 2020. Monthly sales since then have leveled out at a lower level, but still well above pre-pandemic levels. This volume of homes is moving off the market even in spite of the fact that the inventory of homes for sale was at record lows for most of the pandemic.

While demand is unusually high in most markets, some locations are seeing greater competition than others. Notably, Florida and Nevada are far ahead of other states in average monthly home sales at 19.7 and 16.9 home sales per 10,000 residents. Most of the leading states offer a combination of relatively affordable real estate, strong economic opportunities, and temperate climates that make them an appealing alternative to high-cost states like California and New York, which are seeing greater numbers of people moving away. At the metro level, the same trends hold with many so-called “second tier cities” in the South and West experiencing the greatest demand.

The data used in this analysis is from Redfin and the U.S. Census Bureau. To determine the states with the most home sales, researchers at Porch calculated the average monthly home sales per 10,000 residents between January and September 2021. In the event of a tie, the location with the greater average monthly home sales was ranked higher. Researchers also included median days on the market, the percentage of homes that sold above asking, and median sale price. Only locations with available data from Redfin were included.

The analysis found that California averaged 35,210 home sales per month between January and September. Overall, 8.9 homes sold per 10,000 residents. Out of the 46 states with complete data available, California saw the 13th fewest home sales per capita between January and September of 2021. Here is a summary of the data for California:

- Average monthly home sales (per 10k residents): 8.9

- Average monthly home sales (total): 35,210

- Median days on market: 23

- Percentage of homes that sold above asking: 61.1%

- Median sale price: $748,136

For more information, a detailed methodology, and complete results, you can find the original report on Porch’s website: https://porch.com/advice/cities-with-the-most-home-sales-per-capita

Mike LaFirenza writes for Lattice News Wire

Get Citizensjournal.us Headlines free SUBSCRIPTION. Keep us publishing – DONATE