by Robert Hughes

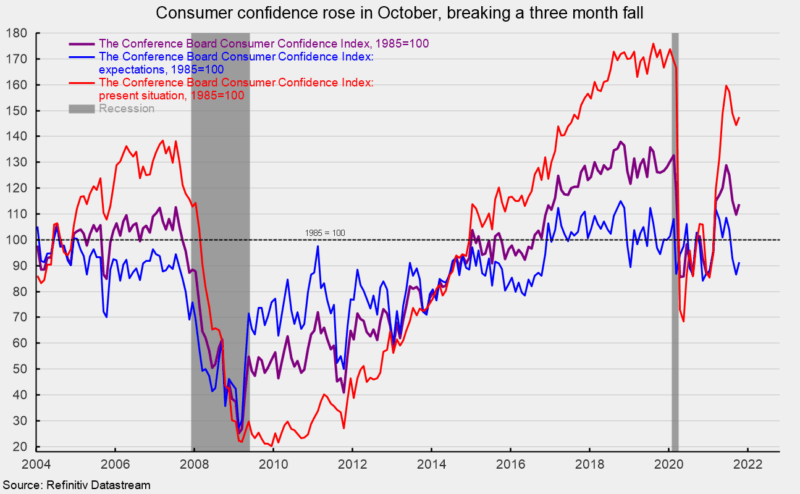

The Consumer Confidence Index from The Conference Board rose in October, breaking a string of three consecutive declines. The overall index gained 4.0 points or 3.6 percent to 113.8 (see chart). From a year ago, the index is up 12.4 points or 12.2 percent.

Both major components of the index rose for the month. The present-situation component increased 3.1 points to 147.4 while the expectations component added 4.6 points, taking it to 91.3 (see chart). The details of the report suggest that consumers’ attitudes are recovering as the number of new Covid cases starts to decline again.

According to the report, “Consumer confidence improved in October, reversing a three-month downward trend as concerns about the spread of the Delta variant eased.” The report adds, “The proportion of consumers planning to purchase homes, automobiles, and major appliances all increased in October—a sign that consumer spending will continue to support economic growth through the final months of 2021. Likewise, nearly half of respondents (47.6%) said they intend to take a vacation within the next six months—the highest level since February 2020, a reflection of the ongoing resurgence in consumers’ willingness to travel and spend on in-person services.”

The one negative aspect in the report was the rise in inflation expectations. The report states, “While short-term inflation concerns rose to a 13-year high, the impact on confidence was muted.” Expectations for inflation 12 months hence rose to 7 percent in October, the highest since July 2008. While the actual number is less important (this data has significantly overshot the actual change in the CPI), the risk is that the psychology of higher inflation expectations can affect consumer behavior.

The outlook for the economy is for continued expansion. However, lingering effects of the pandemic including shortages of materials, labor difficulties and logistical problems are sustaining upward pressure on prices as demand outpaces restrained supply. While the decline in new Covid cases is helping ease the risks to the outlook, persistent, elevated inflation expectations remain a threat.