by William Luther

Inflation continues to exceed the Federal Reserve’s 2 percent target. The Personal Consumption Expenditures Price Index (PCEPI), which is the Federal Reserve’s preferred measure of inflation, grew at a continuously compounding annual rate of 6.1 percent from February 2021 to February 2022, up from 5.9 percent in the previous month.

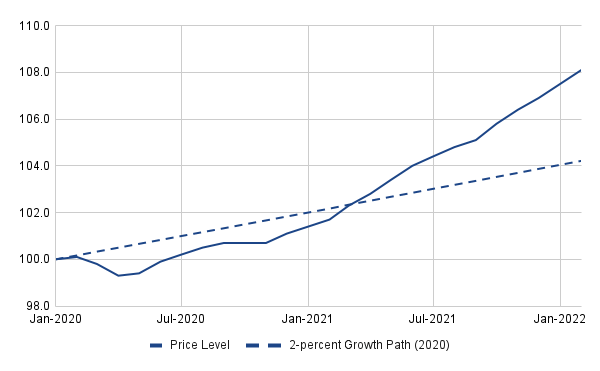

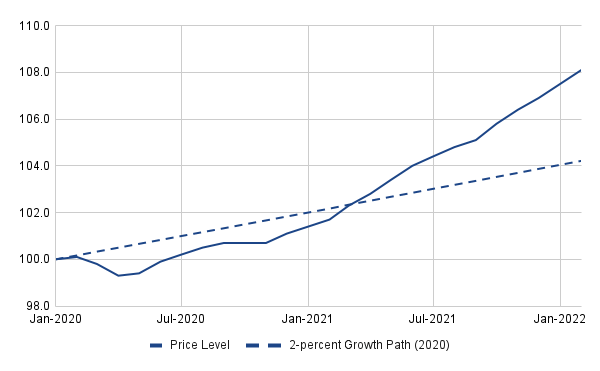

The price level has grown 3.7 percent on average since January 2020, just prior to the pandemic. As Figure 1 shows, the price level was 3.9 percentage points higher in February 2022 than it would have been had it merely grown at two percent over the period.

Fed officials are ostensibly committed to an average inflation target. Under such a rule, a period of above-target inflation would be offset by a period of below-target inflation so that inflation is equal to target on average. The Federal Open Market Committee (FOMC) reaffirmed its Statement on Longer-Run Goals and Monetary Policy Strategy, which describes the rule, in January 2022. But the course of policy projected by FOMC members suggests it is not really committed to delivering 2 percent inflation on average.

In March, FOMC members were asked to project inflation under the assumption that the Fed conducts monetary policy appropriately, as he or she sees it. The median, central tendency, and range of FOMC member inflation projections are presented in the Summary of Economic Projections and reproduced in Table 1 below.

| Projection | 2022 | 2023 | 2024 | Longer run |

| Median | 4.3 | 2.7 | 2.3 | 2.0 |

| Central Tendency | 4.1–4.7 | 2.3–3.0 | 2.1–2.4 | 2.0 |

| Range | 3.7–5.5 | 2.2–3.5 | 2.0–3.0 | 2.0 |

Two things stick out from Table 1. First, most FOMC members think inflation should remain above-target through 2024. The lower bound of the central tendency, which excludes the three highest and three lowest projections, is 4.1 percent in 2022, 2.3 percent in 2023, and 2.1 percent in 2024. Second, no FOMC member thinks inflation should fall below target during the projection window. The lower bound of the range of projections is 3.7 percent in 2022, 2.2 percent in 2023, and 2.0 percent in 2024. In other words, Fed officials do not intend to offset the above-target inflation realized over the last year with a period of below-target inflation so that inflation is equal to the Fed’s target on average during the projection window.

Bond markets are similarly predicting that inflation will remain above target over the next few years and that the Fed will not offset above-target inflation with a period of below-target inflation. On March 30, 2022, bond markets were pricing in around 3.21 percent PCEPI inflation per year over the next five years and 2.66 percent PCEPI inflation per year over the next ten years.

No doubt some will attempt to absolve the Fed for failing to achieve 2 percent inflation on average by pointing to supply disturbances. The COVID-19 pandemic and, more recently, Russia’s invasion of Ukraine have certainly pushed prices up. And an average inflation-targeting central bank should let prices rise in response to negative real shocks. Even still, that’s not enough to let the Fed off the hook.

Although temporary supply disturbances push up prices, they do so temporarily. As restrictions on activity and the risks of COVID-19 subside, supplies rebound and prices fall. Much the same can be said about the conflict in Ukraine, which will eventually end. There is no reason to think these supply disturbances will continue to push prices up over the next three years. Indeed, many of the supply constraints associated with the COVID-19 pandemic should have already reversed given the widespread use of vaccines, less dangerous variants in circulation, and the decisions of policymakers to relax restrictions imposed to stop the spread.

There is also no reason to think supply disturbances have pushed prices up so far. If supply disturbances were solely to blame, nominal spending would remain on trend. In fact, nominal spending has grown much more rapidly. From 2010 to 2020, nominal spending grew at a continuously-compounding annual rate of 3.93 percent. In the time since, it has grown at a rate of 5.06 percent. The high inflation observed over the last year is not merely a supply-side problem. Inflation is high because the Fed has failed to control nominal spending.

Despite affirmations to the contrary, the Fed appears to have abandoned its average inflation target. Excessive nominal spending has pushed prices well above the level consistent with the Fed’s average inflation target. Rather than offsetting the above-target inflation with a period of below-target inflation, as would be required by an average inflation-targeting central bank, the Fed has merely vowed to bring inflation back down to 2 percent. If it does so, inflation will exceed 2 percent on average.

TELL YOUR FRIENDS ABOUT CITIZENS JOURNAL Please keep us publishing – DONATE