A tight labor market precipitates worker opportunities for higher pay and benefits.

The 4th Quarter Report

Written by Dr. Mark Schniepp

The Recent Spate of Labor Disputes

The United Auto Workers expanded its strike against major carmakers on September 22, walking out at 38 parts and distribution locations across 20 states operated by GM and Stellantis (Chrysler). The UAW did not initiate new strikes against Ford as a sign of good faith for the progress being made in negotiations. The new strikes against parts suppliers add more than 5,600 workers to the 13,000 who walked off assembly lines last week.

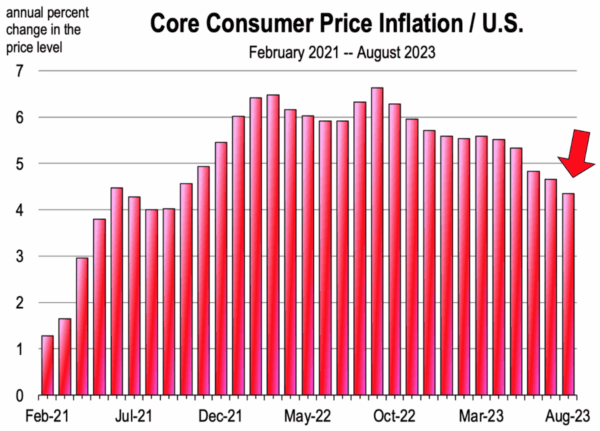

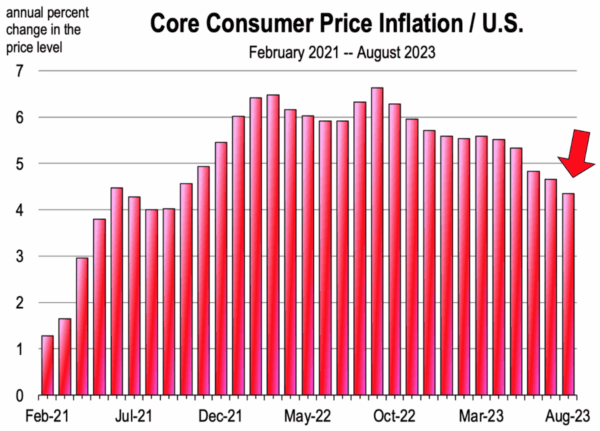

The strike also adds a considerable headwind during a time of increasing economic risks in other areas, including elevated gas prices, a possible government shutdown, and more interest rate hikes by the Fed if core inflation does not break through the 3.0 percent threshold. With this backdrop, the length and scale of the UAW strike will take on added importance.

It is estimated that GM, Ford and Stellantis have lost production of more than 16,000 vehicles over the last week.

An estimated 15,000 unionized southern California hotel workers have been on strike, demanding higher wages and better benefits, since the beginning of July. They joined Hollywood writers and actors, many of whom have been striking since May.

The Writer’s Guild of America demands increased minimum compensation in all areas of media, and increased pension and health plans, and more. The Screen Actor’s Guild is asking for an 11 percent increase in the minimum basic agreement this year, and 4 percent per year going forward. Actors also demand increased residual payments for film and TV.

Last week, the IWLU ratified the labor contract deal agreed to in June after a year long labor dispute at all 29 West Coast Ports. 22,000 impacted Longshore workers represented by the International Longshore and Warehouse Union are now fully back on the job with 8 to 10 percent higher pay and benefits as part of the new contract.

Why is this all happening at once?

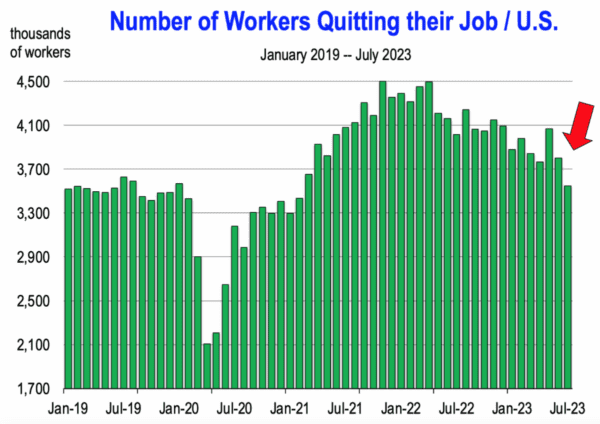

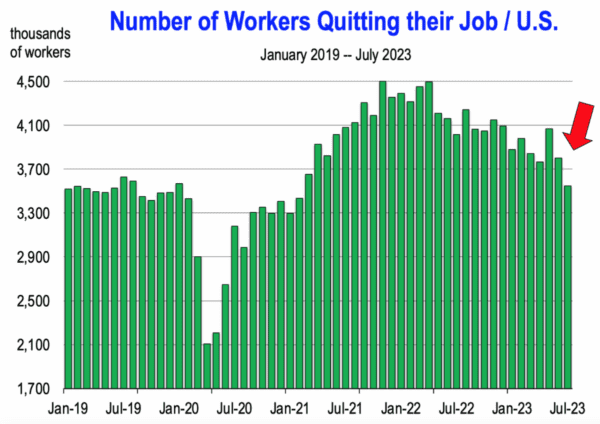

A surge of workers quitting their jobs or giving ultimatums for remote setting work and/or higher pay and benefits are part of the perfect storm of events that has led to growing frustrations by workers in many industries. And unionized sectors now have more strength to force a solution their way.

U.S. Bureau of Labor Statistics, monthly release of job openings & labor turnover survey.

The pandemic left us with supply chain issues after factories shuttered globally, and the erroneous presumption by the federal government that Americans needed copious amounts of helicopter money to survive.

Congress showered Americans with stimulus, leading to the runaway inflation that was rampant in 2021 and 2022. It has moderated this year but levels are still not low enough to persuade the Federal Reserve to steer away from aggressive monetary policy.

Homebuyers panicked during the lockdowns and bought homes like drunken sailors when open houses resumed in June 2020. Sales soared as did prices. High interest rates have led many homeowners to avoid selling their homes in the current environment. The lack of for-sale inventory and high home prices have led many would be buyers to rent, flooding the rental market and driving up monthly rents.

Much of the labor force did not return as the pandemic subsided because boomers accelerated their retirement plans and many families reverted to home schooling their children. A tight labor market resulted, especially when demand for goods and services came roaring back. If you could fog a mirror, you could get a job.

The combination of 40-year high inflation, soaring costs for both purchase and rental housing, and the tight labor market has all conspired to set the stage for pervasive worker demands for higher pay and benefits, or else.

Disruption and Higher Costs

Strikes in general disrupt services and frequently the provision of goods. However, and as we all know, higher wages compensate us, but contribute to rising prices for all goods and services that we as consumers must ultimately pay. And this leads to higher stubborn core inflation due to rising labor costs. While the headline inflation is now at 3.7 percent, core inflation is still at an unacceptable rate of 4.3 percent, more than twice the Fed’s target rate.

I’m not against fair labor contracts or fair wage levels for workers in any industry, but when there is an avalanche of labor market disputes, this leads to the likelihood of meaningful increases in wages and ultimately prices of everyday goods which collectively make everyone worse off.

Amid rising labor costs, employers seek ways to reduce staffing, typically through automation. The onset of ChatGPT, other “generative AI” software for transforming the workplace, and robots will enable firms to ultimately displace workers in many fields, including the ones now in labor disputes seeking higher levels of remuneration.

U.S. Bureau of Labor Statistics, monthly release of consumer price indices for the nation & U.S. regions.

Dr. Mark Schniepp is a VCTF Board Member and Economic Advisor. Dr. Schniepp is currently Director of the California Economic Forecast in Santa Barbara. The Company prepares forecasts and commentary on the regional economies of California.

What a shock! You get what you vote for chumps.

Post WWI meltdown in Austria that spread to Germany. Blame for war loss. Currency dying. Hunger. Military in shambles. Communists organizing. Old leaders ousted. Ripe for a strongman. Parallels hard to miss. And…$peculation in stock market begins.