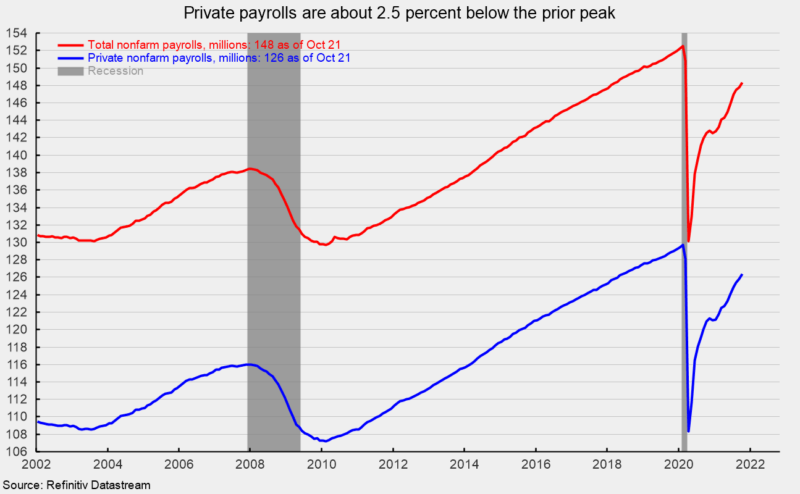

U.S. nonfarm payrolls added 531,000 jobs in October, the best results since the addition of 1.091 million jobs in July. The gain follows upwardly revised gains of 312,000 in September and 483,000 in August. The October gain is the tenth in a row and 17th in the last 18 months, bringing the ten-month gain to 5.8116 million and the 18-month post-plunge recovery to 18.158 million. This is still below the 22.362 million combined loss from March and April of 2020, leaving nonfarm payrolls 4.204 million below the February 2020 peak (see first chart).

Private payrolls posted a 604,000 gain in October after a 365,000 gain in September and 504,000 increase in August. Both months were revised up from their original estimates. The October rise in private payrolls is also the tenth in a row and 17th in the last 18 months. The October addition brings the ten-month gain to 5.346 million and the 18-month recovery to 18.058 million versus a combined loss of 21.353 million in March and April of 2020, leaving private payrolls 3.295 million or about 2.5 percent, below the February 2020 peak (see first chart).

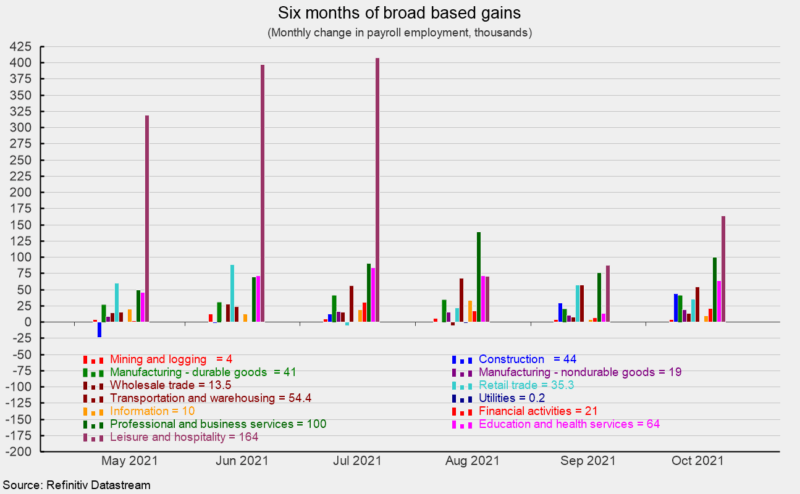

While the pace of gain has varied over the last six months, gains have been generally broad-based (see second chart). Within the 604,000 gain in private payrolls, private services added 496,000 while goods-producing industries added 108,000.

Within private service-producing industries, leisure and hospitality added 164,000 for the month after adding 88,000 in September and 71,000 in August. Among other service industries, business and professional services added 100,000 in October, education and health care services increased by 64,000, and transportation and warehousing gained 54,400. Retail added 35,300 jobs in October (see second chart).

Within the 108,000 gain in goods-producing industries, construction added 44,000, while durable-goods manufacturing increased by 41,000, nondurable-goods manufacturing added 19,000, and mining and logging industries increased by 4,000 (see second chart).

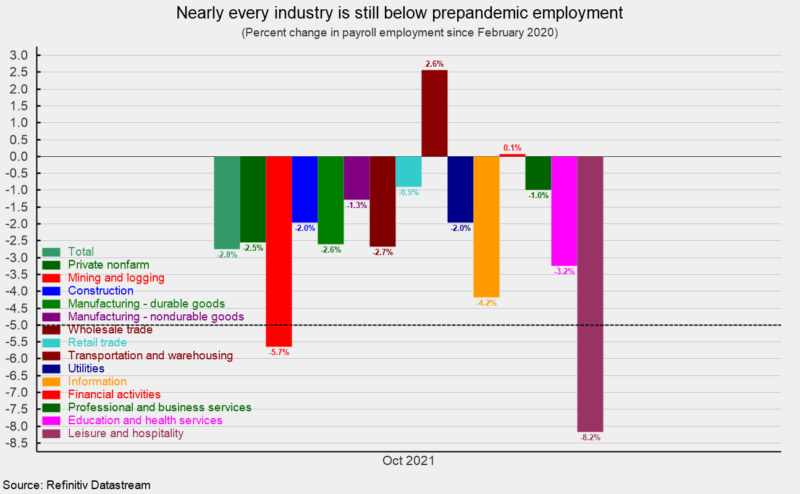

After 18 months of recovery, only two of the major private industry groups have more employees than before the government lockdowns – transportation and warehousing is 2.6 percent above the February 2020 level and financial activities is 0.1 percent above. Two industries – Leisure and hospitality and mining and natural resources – are still down more than five percent (see third chart).

Average hourly earnings rose 0.4 percent in October, putting the 12-month gain at 4.9 percent. The average hourly earnings data should be interpreted carefully, as the concentration of job losses and recovery for lower-paying jobs during the pandemic distorts the aggregate number.

The average workweek fell 0.1 hour to 34.7 hours in October. Combining payrolls with hourly earnings and hours worked, the index of aggregate weekly payrolls gained 0.6 percent in October. The index is up 9.3 percent from a year ago.

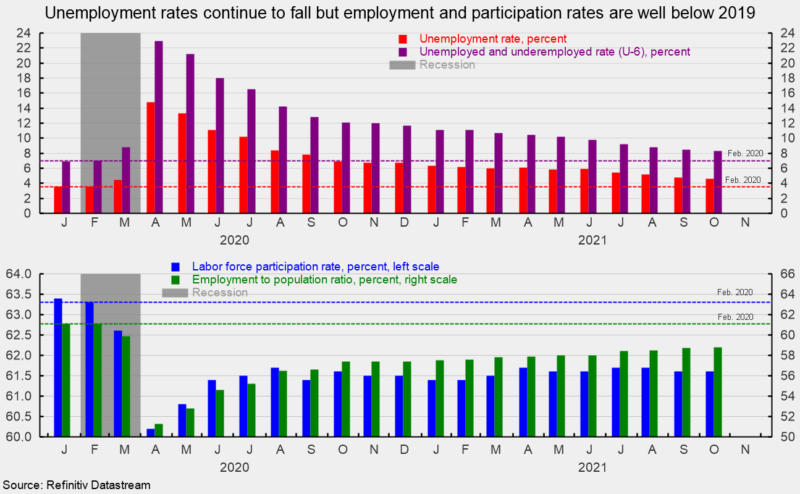

The total number of officially unemployed fell to 7.419 million, a drop of 255,000. The unemployment rate fell to 4.6 percent while the underemployed rate, referred to as the U-6 rate, fell to 8.3 percent in October. In February 2020, the unemployment rate was 3.5 percent while the underemployment rate was 7.0 percent (see top of fourth chart).

The participation rate was unchanged in October, coming in at 61.6 percent versus a participation rate of 63.3 percent in February 2020. The employment-to-population ratio, one of AIER’s Roughly Coincident indicators, came in at 58.8 for October, up from 58.7 in September but well below the 61.1 percent in February 2020 (see bottom of fourth chart).

The October jobs report posted a robust gain of 531,000 in October. Private payrolls were even better at 604,000 and both measures had upward revisions to prior months. The data suggest that the disruptions caused by the resurgence of new Covid cases are now fading along with the number of new cases. This will allow businesses and consumers to resume the move towards normalcy.

However, ongoing materials shortages, logistical and transportation bottlenecks, and labor issues continue to restrain the ability of supply to recover as quickly as demand, resulting in significant upward pressure on prices. These pressures are likely to ease in the coming months and quarters; a 1970s-style inflationary spiral remains unlikely. Overall, the outlook is for continued recovery and while challenges remain, the fading number of new Covid cases should help reaccelerate the economic recovery.