By Wolf Richter at wolfstreet.com:

That they lost gobs of money every year didn’t matter until suddenly it did. But now there’s a new challenge heading for them.

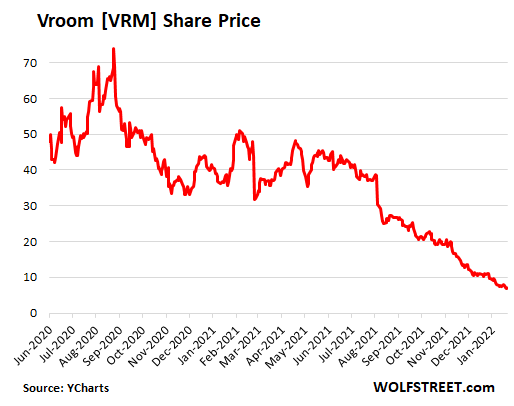

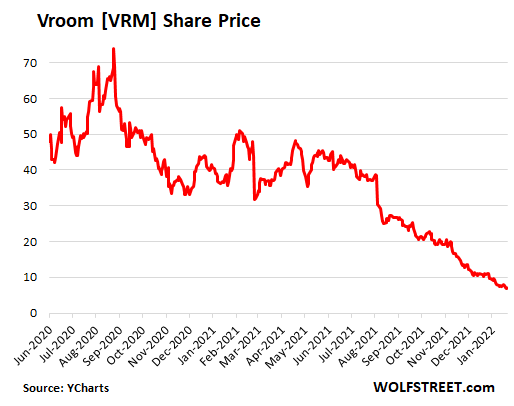

On its first day of trading after its IPO in June 2020, shares of Vroom [VRM], an online-only used-vehicle dealer that has lost piles of money every year, more than doubled from its IPO price of $22 a share, amid enormous hype on Wall Street. It then proceeded to skyrocket to $73.87 by September 1, 2020. And then the hype started to leech out, and on Friday, shares closed at $7.06, down 90.4% from the closing high (price data via YCharts):

Looking at a chart like this gives me the willies because it proves that there is something seriously wrong with how money-losing companies in well-established profitable industries, such as selling used vehicles, are hyped to retail investors and even asset managers as disruptors that are going to change the world, and these disrupters don’t need profits because who cares about profits when you’re changing the world.

And then the Big S hits the fan, after Wall Street banks and the insiders made huge amounts of money. That’s when other folks get cleaned out, having bought into the hype, and some unknowingly by having invested in funds that held these shares. This is now happening with hundreds of companies.

Source http://wolfstreet.com

Get Citizensjournal.us Headlines free SUBSCRIPTION. Keep us publishing – DONATE