BY

U.S. stocks staged a respectable rally Friday, surging on a surprisingly upbeat May jobs report, while safe havens like bonds and gold gave up gains.

The moves extended a stock recovery that has seen Wall Street claw back many of the deep losses driven by the economic fallout from the pandemic.

All three major equities indexes climbed 2 percent or more, with the tech-heavy Nasdaq briefly hitting a new all-time high before ending the session a sliver below.

The benchmark S&P 500 is almost back to where it was earlier in the year, closing 5.7 percent off its record high.

By closing bell, the Dow Jones Industrial Average rose 829.16 points, or 3.15 percent, to 27,110.98; the S&P 500 gained 81.58 points, or 2.62 percent, to 3,193.93; and the Nasdaq Composite added 198.27 points, or 2.06 percent, to 9,814.08.

The Nasdaq Composite Index (IXIC) between August 2019 and June 2020. (Tradingview)

The U.S. economy added a remarkable 2.5 million jobs last month, rebounding from April’s record 20.7 million drop and pushing the unemployment rate down to 13.3 percent. Analysts expected unemployment to soar to a historic 19.8 percent.

“The numbers are a huge surprise to the upside,” said Michael Arone, chief investment strategist at State Street Global Advisors in Boston.

“It would suggest a further confirmation the economy is coming back online,” Arone added. “This is a strong signal that the effects are temporary and that the economy is improving.”

Chief White House economic advisor Larry Kudlow said the strong rebound was not that surprising.

“Preceding this number were a number of ‘green shoots,’ as we call them in economics or finance,” Kudlow said at a White House press conference Friday, referring to signs of economic recovery.

“Housing applications for new homes are skyrocketing,” Kudlow said. “New businesses and new business applications are skyrocketing. So we’ve seen a lot of pieces of evidence.”

Kudlow said the key to the strong jobs number is that many of those who were temporarily laid off have returned to work. He credited the administration’s small business relief loan scheme, the Payroll Protection Program (PPP), which offers businesses forgivable loans if they don’t lay off workers for a period of time.

“The Payroll Protection Program has kept people on temporary call, kept them furloughed but they knew they were going to come back,” Kudlow said, adding that the PPP has distributed $510 billion and “has probably saved as much as 50 million jobs.”

U.S. Treasury yields rose on Friday’s strong jobs data, a move that signals greater investor appetite for risk. It also gives a boost to interest rate-sensitive banks, with the S&P 500 Banks index ending the session up 4.9 percent.

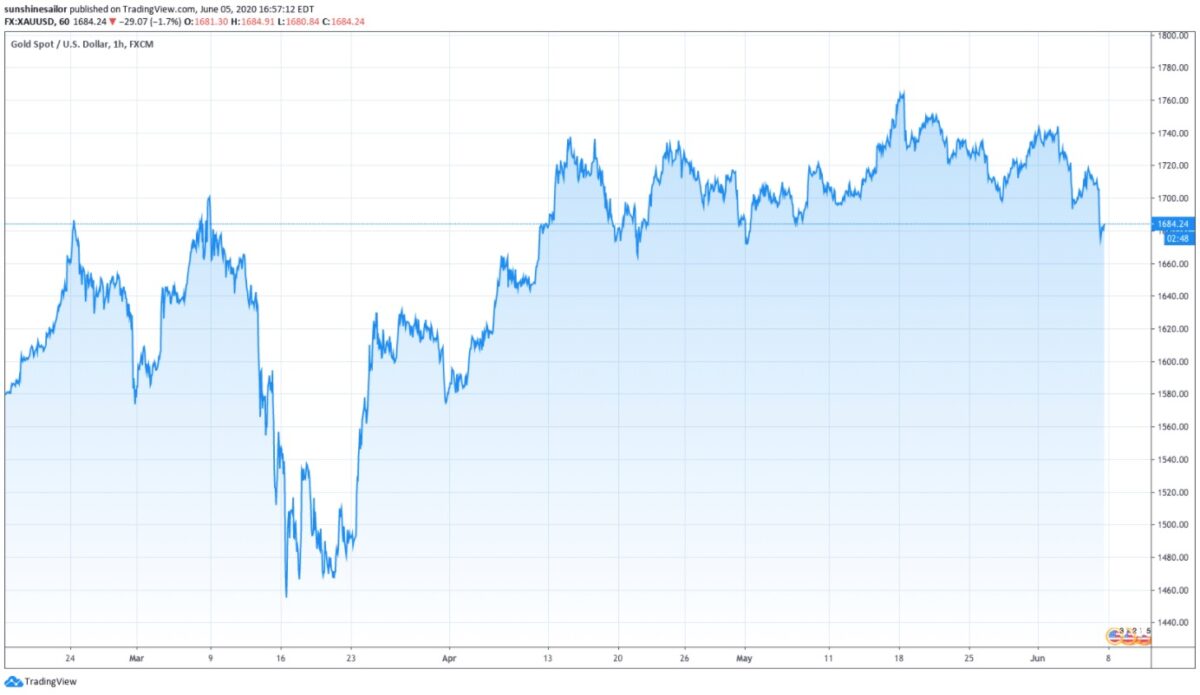

The price of gold, a classic safe haven sought out by investors in times of turmoil, dropped 2.5 percent for its biggest one-day slide since March.

Gold spot price (XAUUSD) between March-June 2020. (Tradingview)

President Donald Trump at a press conference Friday touted the rebound as being better than a V-shaped recovery, which refers to a sharp economic surge after a plunge.

“We’re opening and we’re opening with a bang and we’ve been talking about the V,” Trump said, adding, “This is better than a V. This is a rocket ship.”

The president also cheered the strong jobs number in a series of tweets Friday morning.

“It’s a stupendous number. It’s joyous, let’s call it like it is. The Market was right. It’s stunning!” Trump wrote in a tweet.

Investors are divided between those who believe the dip in economic activity has been priced in, and those who think of the surge in stocks as a relief rally that will soon run out of steam.

Sixty-seven percent of investors in a survey cited by The Wall Street Journal believe the S&P 500’s next 10 percent move will be down.

“Long may it last,” Arone said of the equities rally.

Reuters contributed to this report.

Republished with Permission The Epoch Times SUBSCRIBE

Get Citizensjournal.us Headlines free SUBSCRIPTION. Keep us publishing – DONATE